Following up on my May Portfolio update, time for another one. Given all the mayhem in the markets, it seems pertinent to discuss what I do, and explain why I did those things. Part of the reason I do this is to leave my approach in the open for others to read and offer feedback, but the other part of the reason is to hold myself publicly accountable.

Obviously, my interests in keeping myself accountable and solicit feedback has to be traded off with producing something that would interests readers - otherwise, the blog runs the risk of mimicking a journal - might be an interesting record, but not an opportunity to collaborate with others in the field of investing. So I am likely going to change the format and frequency of the updates a few times to see what sticks and what doesn't. If you like/dislike something you see here, feel free to add a comment or reach out to me in person (in case you know me in person), so I can use that feedback to make these posts more interesting.

Let's get started with the charts and then get on to some commentary in the latter half of this posts.

In general, markets are in a sell-off and will likely be in sell-off till the tide of economic news start turning around. Exactly when that will happen is anyone's guess. However, I have been closely observing how my portfolio does in comparison to the wider falls and I am convinced that the allocations can withstand a drawdown at not much worse outcomes than holding the broad market itself. Furthermore, I am convinced that looking back at this day in 18 months, I am likely to have no regrets about portfolio allocations.

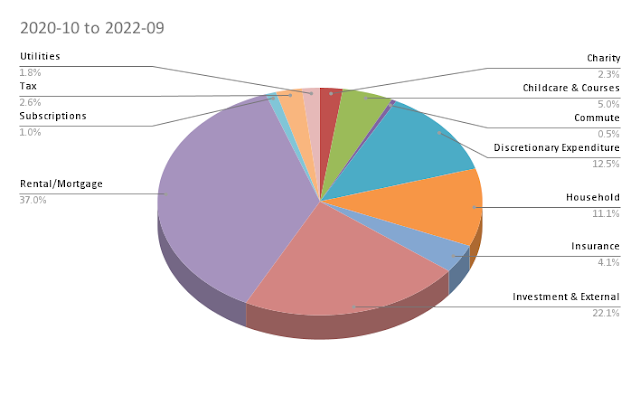

In terms of sectors, Energy and Conglomerates are up, cash and Funds/ETFs are down.

I continue to be bullish on the Energy sector. While Energy sector has also sold off in the last month, it is my belief that energy prices are likely to stay high long enough to make a material difference to the balance sheets of companies that their valuation are going to be significantly different in the next year or two. If a company has a significant debt, accumulated over 10 years, on their balance sheet and get to write all of it off in a year's earnings, it is likely to make a significant difference to their capital allocation and returns going forward. Coupled with the cheap prices at which these companies trade, it is likely that their valuations will significantly improve in the next 2 years.

That said, I am fully cognisant that these companies are under threat of long term extinction given the energy transition we are undergoing, and likely to be negatively impacted by government interventions like

Windfall Taxes. All in all, I believe they are a worthy addition. However, I am selective about which companies I invest in and I have been conservative in selecting those opportunities that I feel have the lowest downside.

(note: My Energy exposure is larger than the 8.2% showing up in the pie chart above, because I am also involved in a bunch of derivatives which are carried at low value, but hold a high capital-at-risk / intrinsic value. This is all buried in the Derivatives slice in thesis. Doing the right maths to get it accurate is too much work, I don't get paid to write this blog, and I am lazy. 🙂)

As for Fund/ETF allocation, I made use of the current meltdown in the markets to take out money from funds and reallocate them into individual stock allocation managed by me directly. These fund weren't doing a particularly great job and redeeming them now means I will get to exit them without a significant taxable gain. In addition, I get to move the proceeds into my Interactive Brokers margin account, where I will have the option of using the additional funds to leverage my positions. I am very careful in not using leverage, but as the market falls, it is always better to have a higher margin available in case I decide to start ramping up positions. Never let a crisis go waste!

In terms of

regions, US is up, with also a small increase in China allocation, and everything else shrinking accordingly. US is up primarily because of some of the energy trades as well as an addition to my

Berkshire-B holdings.

In terms of

thesis, Special situations (merger and acquisition arbitrage, liquidations, etc) has grown as a big thesis in the past month and is likely to continue to grow over the next few months. In what is an extremely volatile market, building up convictions on special situations seems relatively easier for me. Some of the situations I have been involved in last month are

Activision acquisition arbitrage,

Spirit Airlines acquisition drama and the

Twitter acquisition arbitrage. I played all of them with conservative positions by being short on PUTs, just to be safe, and collected a bit of pocket money premium here and there. If nothing else, the put premiums fund my cups of chai!

I have also added tracking Private Equity as a new slice of the pie. For the avoidance of doubt - I didn't acquire this position in the last month. I only started tracking it in the last month. Going forward this should continue to represent a slice of the pie. Most of my Private Equity investments come from my employments - my current employer Quantcast, my previous employer Vocanic, Rhino Partners - a company I co-founded, Advocacy - in which I played an advisory role and RangDe, a not-for-profit NBFC that I supported during their capital raise, not for profit motive, but to support their work in society.

In summary, I remain a net buyer and I have been adding a lot to either special situations or stocks that have become cheaper in the sold off, and whose prospects I am confident of - Berkshire Hathway, for instance, which is now among my top-3 holdings.

Top 3 Positions

In alphabetic order:

Headline Performance Numbers*

| Return | Alpha^ | Benchmark |

| 1 Year | 4.29% | 4.72 | |

| 3 Years | 10.59% | 4.32 |

| 5 Years | 9.65% | 2.75 |

* Beta for this calculation is monthly.

+ I use Vanguard FTSE All World All Cap (Acc) as my benchmark. Ideally I should be using the underlying index and not the fund itself, but doing so is a lot harder. Getting good clean data on the index, and needing to track its tax and dividend implications gets too cumbersome. Using the fund is the closest proxy, however, I am aware that it is not a perfect benchmark, as fees get added, and tracking errors start showing up. I believe they are minor in larger scheme of things.

Comments

On the other hand, the fund is Accumulation, which means all of the dividend reinvestment, and the book keeping is managed by the fund. Additionally, the fund can be set to auto-buy which means I can allocated exact ££ amounts. I am sure that can be replicated by fractional shares, but I am not yet a huge fan of fractional holdings. That's the reason I have chosen to own it this way.

This is not to say the ETF is a bad idea. They both are equally good options - just a matter of minor personal preference.