A comment on volatility

(Anything mentioned in this post should not be considered financial advice. The thoughts in this post are purely for entertainment and educational purposes.)

Stock markets are a powerful asset class, for a variety of reasons:

- They offer superior medium to long term returns.

- You can invest in, and divest from, them in a systematic manner, eliminating timing risk.

- You can invest in them with very small amounts, something you can't do in other asset classes such as property or bonds which often have minimum lot size, or private equity.

- You can massively diversify your investments with almost no effort, given the proliferation of diversified index funds and ETFs available in the market.

- You can invest and get good returns without needing to resort to leverage (unlike say property where leverage is almost always a given) - i.e. without needing to borrow money from others.

- Your investment maintenance cost and energy is next to 0. In contrast, if you were to own gold, you have to worry about its security and might even have to expend some money for its secure storage. Or if you were to hold property, you have to buy insurance and perhaps have to deal with maintenance of the property from time to time.

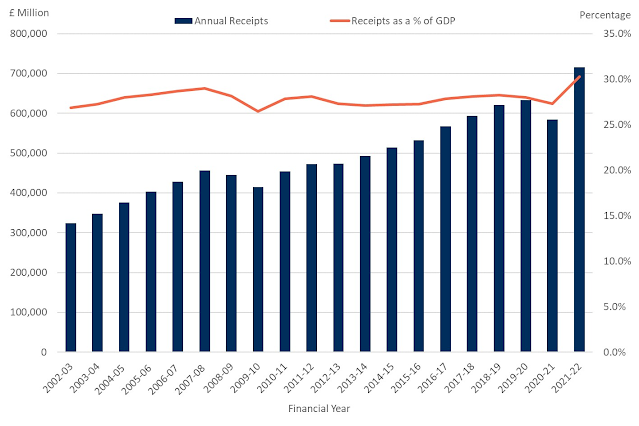

In exchange for all of these fantastic goodies, stocks markets have provided healthy returns for the past many decades - here is a graph from the last 10 years.

However, there is one major drawback - volatility. Volatility in stock markets are a given. Volatility is a price that you pay for the superior returns and all the goodies that I just mentioned above that are the characteristics of stock market investments.

From Morgan Hausel's superb book Psychology of Money:

Market returns are never free and never will be. They demand you pay a price, like any other product. You are not forced to pay this fee, just like you are not forced to go to Disneyland. You can go to the local county fair where tickets might be $10, or stay at home for free. But you’ll usually get what you pay for. Same with markets. The volatility/uncertainty fee – the price of returns – is the cost of admission to get returns rather than low-fee parks like cash and bonds.

If anyone promises you a lower volatility return, it is then almost always the case that they are diluting stock market returns by adding something else to the mix. They could do so by adding bonds, or property, or other assets like gold or bitcoin, or perhaps pay to buy up hedges - essentially insurance on the stock market. All of these are legit methods, but it alters the composition of what you hold and changes the consequent characteristics - potentially reducing long term returns.

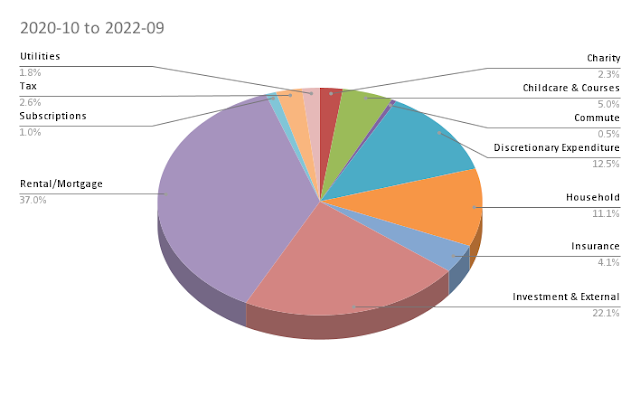

For someone like me who like the good parts of the stock market (mentioned above), that's generally undesirable. So I have often not bothered too much and have allocated an outsized position of my family wealth in the stock markets - somewhere between 70-75% depending on when you ask me. It has gone upwards of 95% at times, but for the past few years it has been hovering between 65-75%.

What do I do about volatility?

Before I say something about it, let's look at some data. I recently backfilled my own investment data going back to 2010. This data tells me how my wealth has grown. For each month in the intervening period, I now have the following data (with reasonable level of accuracy):

- Snapshot of the value of the Portfolio

- Amount invested in the month

Given these two params, you can then create a month by month performance chart. That data is pretty interesting

It has an average of 0.89%. If you were to add up 0.89% 12 times over, you get 10.68%** which is roughly the per year returns at which my portfolio has compounded annually for the past 11 years or so.

However, it also has

- a standard deviation of 5.6%.

- of the 120 months tracked, 75 were up months, and 45 were down months.

- on the good months side, I have had 11 months > 10% and on the bad side I have had 4 months < -10%

Volatility in an inescapable part of being in the markets.

What to do about it?

A large part of dealing with volatility is to just let it be. It is a price you pay for gaining access to this wonderful wealth generation machine. Unless you need the money in the near term, worrying about volatility is the wrong way to look at the situation. Remember Volatility is not Risk. Read here and here about this idea.

The second important step is to avoid concentration. If you are concentrated, either in a single country, or single sector or a single style of companies, you are likely to increase the possibility of prolonged or permanent loss of capital. What you want to do is to reduce that possibility by being significantly diversified. See my own diversified portfolio as an example.

Once you have achieved a required level of diversification, then sitting out volatility might be mentally difficult but logically the best choice.

** I know you can't just add up average monthly returns to get annual returns. I am trying to simplify to make a point. For the detail oriented, the returns were 11.26% inclusive of dividends but gross of taxes. All returns used here are based on GBP basis. In other currencies, returns were 8.66% in USD, 9.29% in SGD and 12.39% in INR. ↩

(Anything mentioned in this post should not be considered financial advice. The thoughts in this post are purely for entertainment and educational purposes.)

Comments