Special Situations, and a debrief on $TWTR

While I mostly focus this blog about general thoughts on investment, and not so much on the specifics of the investments and trades I make, I am going to take a bit of detour and use this post to write about one category of investments I do a lot - Special Situations.

What do Special Situations mean? It is the collection of all situations where something is happening with a particular company/stock/security that may have nothing to do with fundamentals or valuation. These include acquisitions, liquidations, delisting/re-listing/dual-listing, forced selling/buying.

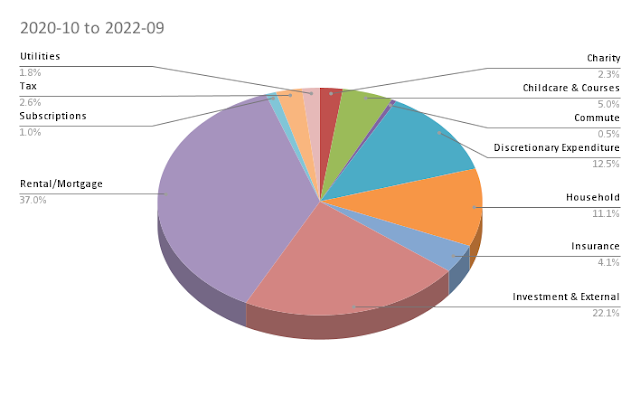

In the last 2 years, led by the fact that I am subscriber to Raper Capital blog, and he has spent an inordinate amount of his research time on these kind of investment opportunities, I have also been drawn to them. It is not that I have gone all in - most of my investments are still buy and hold of the kind that I would happily set aside to gift my daughter (minus the Tax-person’s cut), but I have increasingly allocated more and more capital to these situations to benefit from some rather asymmetric opportunities.

Let’s take a few examples. A few successful ones from the past are:

- Hunter Douglas - a stock that the owning family wanted to take private, but eventually sold to a PE firm

- Haier Corp - a stock whose german listing was trading significantly cheaper than its Hong Kong listing and the bet being that the prices will converge.

- Tattooed Chef - big gap between the warrant and the price of the underlying stock

- Think Childcare - acquisition arbitrage, punting on acquirer paying more than what they have currently offered

Don’t get me wrong, there have been a share of unsuccessful ones too:

- Casper Sleep - hoping that the acquisition won’t happen (but it did)

- IAG - shorting (in 2020) with the hope that the rights issue will significantly reduce the share price. After adjusting for the rights (which you were short too, and had to acquire back to close the trade), it didn’t.

- Capricorn Energy - hoping that the Tullow deal won’t go through, and that CNE team would extract much more value from the company

- The Works - hoping for reinstitution of dividend endearing it to markets (it didn’t)

This is obviously not the full list and like everything else, the outcomes form a bit of a normal distribution. There are some very good outcomes, some very bad outcomes and most of the rest kind of clump together around 0 returns (not much profit, and not much loss). Collectively, however, the hope is, like any other portfolio that you build, that your winners carry you significantly farther than your losers hold you back by.

If you select your special situations well, such that the downside is generally kept low but have a small opportunity of a significant upside, then this technique largely works and overall you end up making a reasonable quid or two. You also carry lower volatility on your books, as special situations often don’t move till the time of reckoning comes, and then it either shoots up or down, and you get to close your trade either way. In a sense, it helps dampens the jumpiness of the rest of your portfolio.

However, this method of investments need you to do a lot more research, pay a lot more to your brokers (many special situations trades are OTC and hence cost more brokerage) and perhaps carry interest costs too (as you may not want to carry currency risk if the trade happens to be in a currency you don’t want to hold).

So, the risk-effort-returns aren’t much better than other kinds of investments, but it has generated a little bit of alpha for me, compared to everything else I hold, so I would like to keep it going.

A Debrief on $TWTR

From almost the beginning of the acquisition drama, I have had my eye on this trade and have been following it rather closely. It is one of the rare Special Situations where I made my conviction almost entirely on my own (though I was reading and hearing a lot about it from people like @compound248, @annmlipton and @andrewwalker).

I traded this rather conservatively at the beginning, but then got bolder and bolder. My trades looked like:

- In May, selling the 18 Aug 22 Expiry $30 Strike PUTs for $2.30 (collecting $2.22 per share)

- In Mid-July, buying $TWTR outright for 36.10 and selling it at 42.90 (netting $8.80 per share) in August

- In August, the same day I sold my previous lot of outright shares, I bought the 40/45 Risk Reversal on Twitter with a Nov expiry, for a credit of $0.14, which I closed early in the month (netting a total of $6 per share)

- Finally, entering the stock again on 7th October on 49.15 that I closed last week for 50.50 (netting another $1.35 per share)

Low Probability of Success / High Upside vs High Probability of Failure / Low Cost of Failure

High Probability of Success / Low Upside vs Low Probability of Failure / High Cost of Failure

Comments