Experiments with Retirement Drawdowns in India

4 years ago, my very-much-retired parents sold a flat in Bangalore that they owned. In the years leading to that, they were receiving a bit of rent, which provided a bit of cashflow, but wasn't close to the kind of yield they could have generated from the same amount of money being in liquid forms - bonds or equities. As they were going through the process, they asked me what's the best thing to do with the money they were about to receive from the sale.

The natural response to this situation is to put all of the money into safe money-market or government funds or fixed deposits (FDs) that would yield a safe return and not have any risk of loss of capital. However, given where the interests rates have been, the yields weren't going to be too great. This is a problem a lot of retirees face today, and one I might have to face myself in future. So I was very much interested in finding a solution that worked.

But what does "working" in this context mean? For me, working in this context means the following:

- There should be a steady stream of cashflow that my parents can use for their day to day expenses.

- Such a stream of cashflow should ideally run till they lived.

- There must be a scope for increasing the cashflow if they so desired based on inflation and other needs.

- This arrangement should come with minimal intervention.

- As a plus, the corpus can be passed on in inheritance.

When it comes to retirement planning, so much more is written about saving, investing and accumulating, than is written about drawing down on the corpus you build over all these years. The options are largely limited to

- live off a safe withdrawal rate of 3-4% or

- live only off the dividends of your investments.

- Buy annuities

Neither of this approaches are appealing to me. On one hand I find 3-4% way too conservative. If markets in general return 7-9% in the western world, or 12-14% in a country like India, shouldn't we be able to enjoy somewhat similar withdrawals and still largely be able to let the corpus run forever? Perhaps a small amount of buffer makes sense, but 3-4% invariably leaves a good amount of growth of capital untapped for the majority of the withdrawal phase.

As for living off dividends, it has the great feature of protecting your holdings, but given where asset prices are, you will likely get far less than even 3-4% on a balanced portfolio. You could obviously seek a portfolio biased to income generation, but such a portfolio doesn't correlate to general stock market returns in the long run and are likely to underperform markets in general.

Annuities aren't workable these days - premiums in the last decade are so high that these would have yielded only a paltry yield, while swallowing up your capital altogether.

So, what's the solution then?

My solution was somewhat simple - invest all the monies into broad market equity funds and conduct a Systematic Withdrawal Plan (SWP) from this. If you keep the SWP close to the expected long term returns, perhaps leaving a small buffer for safety, you can receive a much higher yield - closer to 10% instead of the lower options available with other arrangements.

(This has the added benefit that is everything worked well, I get to inherit the corpus after my parents don't need it. However, I also had to promise them that I would make them whole if the strategy failed altogether. There is enough trust between my parents and I that this works. This won't work for all families, obviously.)

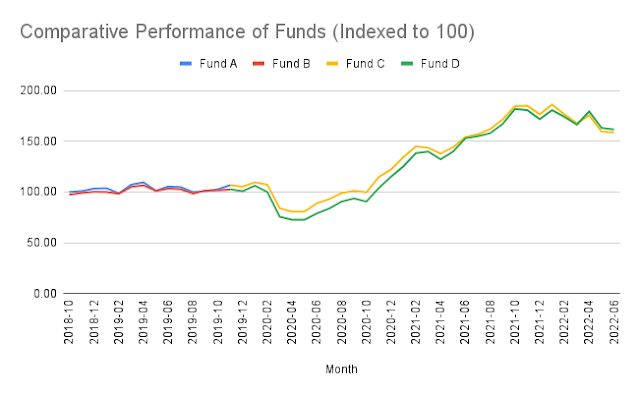

In India, setting this kind of arrangement is relatively easy, so this needs little intervention. We chose Franklin Templeton India for this. The corpus was divided into 2 funds - Fund A and Fund B (full names below). A few months later we figured out that Fund A and Fund B were both fully loaded funds with high fees and that we can move to a lower fees arrangement. At the end of the first year, I transferred the funds over to Fund C and Fund D which were the lower fees equivalent of A and B. Since then this arrangement has largely been left untouched.

The choice of these funds were simple for me because I had been investing in them to build my own corpus since 2005. I knew these funds quite well - so kept my choice quick and simple.

I set the drawdown to 9% of the corpus, and adjusted it to 10% after the first year.

|

I find that this strategy has worked reasonable well, at least over the past 4 years, despite some market idiosyncrasies. All else being equal, it might work for many more years, if not decades.

Obviously, if you live outside of the India, entrusting your retirement corpus on to a fund in India and hoping it will all work out, is probably a bad idea. If you aren't invested in India, then expecting the corpus to return 9-10% consistently without eroding permanent capital is also perhaps being too ambitious. However, I feel that this strategy tells me that I could form a similar strategy for my own withdrawal phase, after perhaps adjusting some of the numbers. At the moment, it looks like holding a global index like FTSE Global All Cap Index Fund, and then aiming for a drawdown of 6-7% should work out reasonably well for those living outside of India.

I have put together all the raw data here, for those who would like to go through. I have adjusted the original corpus to be INR 10L so that the original amounts are hidden. All numbers have been made proportional.

Comments