Movements in the Crypto World

(Note: I am going to use bitcoin as a poster child of crypto in this post. I am aware that crypto is far more than just bitcoin, and it is very likely that the larger crypto world and bitcoin may likely diverge in their paths in the future, but at the time of writing, using bitcoin to speak about crypto seems reasonable.)

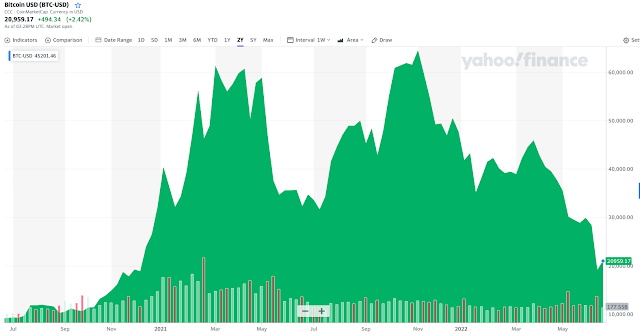

There is a crypto correction/collapse/drawdown in action at the moment. About a year back, I wrote about my thoughts on crypto and for better or worse, I never ended up taking a position in crypto and hence suffered neither profit nor loss in what has happened to those markets over the past 24 months. However, it has been exceptionally hard to ignore the crypto market and to stay out of it while everyone and their pets were investing in them.

In general, assets are bought because they are expected to give you something back in return. The mathematical model that works to explain this is the Discounted Cash Flow Model (DCF). For anyone with high school maths competency, DCF is an incredibly powerful tool that allows you to model almost any financial asset. DCFs can be used to model anything from a private business, to stocks, to real estate, to bonds, to annuities and so on and so forth.

The tools needed to perform a DCF are incredibly ubiquitous too. All you need is a spreadsheet and knowledge of some formulas, like NPV, FV, etc and you are good to go. Of course, DCF is also a dangerous tool, as you can input it with values to fit whatever output you would like to rationalise a purchase you wish to make. So, it is important to use it the right way to understand whether or not an investment is sound.

Regardless of whether you use it properly or poorly, DCF at least gives you an opportunity to value a financial asset based on a model, whatever the flaws might be. My biggest issue with Crypto, at least Bitcoin, has been that there is no way to do a DCF calculation on crypto. Since many crypto currencies don’t produce a cash flow and are entirely priced on whatever you and the counter-party chooses to value it on, there are wild swings on valuations. This is not to say other assets like stocks don’t swing wildly - they swing wildly because what goes into the DCF models change; Crypto can swing for far less rational reasons.

Of course there are ample attempts at fundamental analysis for what crypto should be valued on, just that they have all been very unconvincing. The holes are much bigger to observe than the argument themselves. There are of course some cryptos where valuations can be made, but they are not as attractive as comparative assets in non-crypto world as yet (More in appendix).

What then explains the fact that quite a few investors (at least in the US) investors hold bitcoin? There are a couple of possible reasons:

- Investors didn’t understand the fundamentals behind the crypto pricing, but for all practical purposes, they don’t understand stock market valuations too, and so, if stock markets can return healthily, then why wouldn’t another asset class with broad ownership also return healthily? Basically, this is the “everything goes up” rationale.

- Investors knew that the fundamentals didn’t exist, but invested nevertheless.

My own anecdotal evidence suggests that a large majority of investors who understand fundamentals and have been using them to guide their investment decisions in the past ignored them and invested in bitcoin/crypto regardless.

If indeed, people were investing knowing well they don't know what the future valuation of an asset should be, what is driving them to do it?

I am going to conjecture that it is some combination of greed, envy and fear of missing out (FOMO) that has led so many investors to acquire crypto.

- I want to get rich soon. Stock markets are too slow in generating wealth. Bitcoin is going up and up. If I buy it now, I will be rich, hopefully, soon.

- My neighbour/cousin/colleague/nephew bought crypto and they gloat about their massive returns and they can afford better things than I can, so let me put some money there and enjoy similar benefits.

- Oh no, the world is only going to crypto and I will be left with worthless assets like cash. Let me get into it before the transition is complete.

All natural emotions. All incorrect emotions.

- Unless you understand an asset incredibly well, too good to be true is almost always true. Better to get rich slowly than become poorer quickly.

- Doing what your neighbour does just because it has worked out in the recent past is a sure shot way of getting your own finances in a knot.

- As for FOMO, there has never been an asset class that came and took control of the world's wealth overnight. Every asset that has promised to do so has ended up in a bubble and has collapsed. That was true in 1720. That’s true in 2022. 300 years of analysis of bubbles always indicates the same pattern.

Just to be clear I am not against anyone investing in Cryptocurrencies or in Bitcoin (or for any assets for that matter). All I am suggesting is that you should do it for the right reasons and not for the wrong ones. There are ample investors who are spending time deeply understanding cryptocurrencies and the movements in that work and are taking positions and pulling it off. If you are one among them, more power to you.

Morale

- Invest for the long term. Get rich slowly.

- Invest in things you know and understand at a reasonable level. If you don’t know something, then be comfortable foregoing returns on that asset class. It is better than losing money on something you don’t know.

- Don’t get swept up in greed, envy or FOMO - none of that matters. Perhaps create a checklist with these 3 tick boxes and use it every time you invest to make sure you aren’t buying it either due to greed, envy or FOMO.

One crypto asset where a DCF calculation makes sense is with Hedera protocol, which is among the most efficient crypto protocols, using the gossip about gossip protocol for establishing consensus on the public ledger. Despite being the most efficient blockchain algorithm, they would still need O(log(n)) time units and O(n*log(n)) messages to achieve what is currently O(1), n being the number of participants on the blockchain. We obviously want the blockchain to have enough participants to make it decentralised, but not too many, as it increases costs.

Given that Hedera is based on proof of stake and not proof of work, Hedera would generate cashflow by paying back the owners of the coins who stake their coins, to the extent they can charge their clients for processing a transaction. For instance if Hedera could indeed power transactions at roughly the same price point as Visa, and distribute its proceeds to its coin holders as a “dividend” or a “staking fee”, I can see a DCF model fitting nicely.

Hedera has still not started operating a visa-styled system and I am sure that building that kind of infrastructure will take years and also need change of systems at multiple locations along the ecosystem (merchants, users etc), but if they pull it off, you can start doing calculations that mimic the numbers we see from Visa:

To be clear, Bitcoin is not Hedera and its protocol is way too slow and way too costly for us to make a reasonable comparison between Bitcoin and Visa. However if DCF were to work on a crypto asset, then Hedera seems like a much better asset to model on than Bitcoin. Hedera needs to build a much bigger network and conduct a lot more paid transactions for it to be taken seriously, but at least we can make a reasonable approach to valuing the ecosystem. ↩

References:

https://usa.visa.com/dam/VCOM/global/about-visa/documents/aboutvisafactsheet.pdf

https://annualreport.visa.com/financials/default.aspx

https://hedera.com/hbar

Comments