Moving your UK pensions to Interactive Brokers

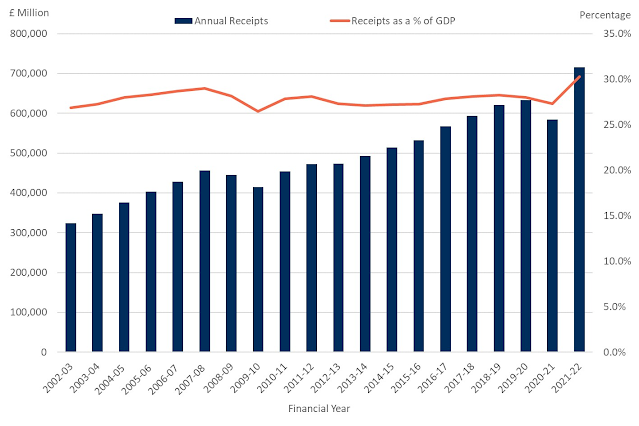

Sometime in 2020, I started falling in love with the UK Pensions contribution system. The idea of being able to put away money for your future, in exchange for a deferral in taxes, is a great idea. For most of us, you can get anywhere between £0.72 to £1.63 for every £1 contributed, in immediate tax benefits (at 40% marginal tax rate and 60% marginal tax rate, + National Insurance).

In exchange for this very generous gift from HMRC, you lock your money till you are 55, and promise to pay taxes on 75% of withdrawals, which can be structured to be lower than the tax rates you pay today. Essentially, it is a sweet deal in exchange for lack of immediate use of money.

While your employer will, in most cases, contributed 8% of your income (4% from their side and 4% from your side), you can increase contributions to up to £40K a year. The exact amount of contributions you can make needs some accounting to be done, since the UK Chancellors, in their infinite wisdoms, have instituted a taper on Pension contributions too. You should consult Pension Annual Allowance Calculator to get the right amount you can contribute in a year. However, for most of us, there will be a very healthy GBP figure of possible pension contributions that can be put to work with an attractive tax benefit on Day 1.

When I first moved to UK, I didn't like the trade off (of locking up money till 55), but over the past 2+ years, I have converted to an admirer. This is partly due to the fact that I am now 2 years closer to that 55 mark (getting older solves some problems after all!) and that I have built up enough of a bank balance outside of the pensions system that I am comfortable locking greater portions of up new cashflows into the pensions system.

Vanguard

My company contributes pensions to Aviva and I had taken a look at the Aviva funds and realised that I didn't quite like them. So when I first hit upon the idea of increasing my pension contributions, I executed the simple but effective option of opening up a Vanguard SIPP account and started adding up monies there. This turns out to be a sub-optimal idea.

Contributing pension before it becomes part of your taxable income (i.e. salary sacrifice) is more tax beneficial than contributing pension after you have received the money in your account. This is because National Insurance is not applicable in the former but is applicable in the latter. Additionally, in the latter case, you have to file a tax return and receive your refund in tax before you can realise the tax benefits, in comparison to the former case, where the tax beneficial treatment is applied before the employer deducts taxes, giving you some time benefits too.

With all that in mind, I started instructing my company to deduct increasing sums of monies from my salary and contribute to pension. I would then go to Vanguard and ask it to fetch the Pension Contributions from Aviva every now and then. This system works pretty well. Between Aviva and Vanguard, the process is painless and the money moves within a week and I was free to use the capital on my Vanguard account, which I was mostly using to deploy on ETFs and Index funds.

Vanguard is an exceptional good place to keep your pension monies deployed in passive investing. They charge you 0.15% of your holdings per year for your pension account and their fund charges are among the most competitive anyway. On the plus side, they have a reasonably good selection of index funds and their reporting is pretty good. On the negative side, they provide you access to only Vanguard funds, and they don't allow any stock trading.

Interactive Brokers

Over the past 3 years, I have moved all my stock broking activities to Interactive Brokers. IBKR provides an exceptional combination of price and power that has made them the go-to-choice as a brokerage. Among the brokerage options available in the UK, IBKR stands head and shoulders above competitors like Hargreaves Lansdown and Interactive Investor, primarily due to

- Lower Trading fees

- Lower forex fees

- Greater selection of stocks from various markets not yet covered by HL and II

- Ability to use margin in creative ways - I won't go too deep into this as this is a double edged sword and needs careful thinking before option to use. Nevertheless, it remains an important benefit.

I have become more and more comfortable at my own portfolio management ability and wanted to explore the benefits of deploying the pension capital towards my own portfolio. For that to happen, I need a brokerage account supporting pension inflow and outflow. This is normally the domain of HL and II. However, given the additional trading and forex costs, I wasn't too interested.

Most people don't think of trying IBKR for their pension pots, because it is not a well-advertised service, with only a cryptic "Approved Interactive Brokers UK Limited SIPP Administrators" page on their site offering a glimmer of hope.

One of my friends approached them and found out more about the role of SIPP administrators and turns out that SIPP administrators are nothing more than an agency set up provide key reporting and regulatory compliance and enable your pension monies to be deployed at a wast variety of destinations, including commercial real estate.

I liaised with two of the IBKR approved administrators - At Sipp and Options Pensions, and got their charges list and service options. While both of them are roughly in the same ballpark, At Sipp was found to be the better of the two both in price and in reviews on the internet.

In effect, At Sipp offers a lean option called Solo Sipp that is meant for your money to be deployed at one destination (IBKR in my case) at a one-time set up fee of £186 (incl. VAT) and an ongoing charge of £339.60 (incl. VAT). If you are deploying a capital of £34K, that is roughly 1% of your capital in At Sipp's fees. Aviva was charging me 0.5%, so at about £68K, of capital deployed, it breaks even compared to Aviva. To breakeven with Vanguard, you need to be deploying about £226,400.

The At Sipp fees at on top of what you would need to pay to IBKR to keep your account there, including trading and forex fees. So, the option of using IBKR for your pensions is only worthwhile if your incremental returns (compared to funds at Vanguard and Aviva) is significantly over 1% - perhaps closer to 2% or 2.5% to be on the safe side. If this is not the case, you might be better off sticking to passive funds at Vanguard.

In my case, I don't have nearly as much as £226K to deploy. However, I am comfortable taking the £339.60 hit per year, with the capital I am planning to deploy, in order to have access to the capital at IBKR, where the flexibility of allowed markets makes investing worthwhile.

The process

On March 31, I sent out the account opening form to them. From here on, the process is excruciatingly slow, as the paperwork goes between you, At Sipp, IBKR, and your current pensions provider (Aviva and Vanguard in my case) to set this up. The process is roughly:

- You sending an account opening form, IBKR template, and a pension transfer form to At Sipp. The IBKR template is used to mention which of the IBKR products you want to use, and how much of your capital you want deployed there. (I chose an amount that was close to 95% of my pension capital)

- They would open an account for you and, in parallel, initiate

- the opening of an IBKR account (this has to be a separate IBKR account that is controlled by your SIPP administrator but you get access to for day to day transactions)

- the transfer of funds from your current providers

- When you fill up the IBKR account opening, it is placed in a suspended state, till At Sipp confirms to them that all is in place and the account can be functional. For this, this happened last week, some 5 weeks after I filled out the account opening form.

- In parallel, the conversation between At Sipp and Vanguard for transfer of money went through some hiccups and I had to get on a phone with Vanguard to iron out a few matters related to the transfer. In effect, Vanguard has an unadvertised policy of either allowing full withdrawal or upto £10K less than the pre-transfer balance. Since I had initiated a partial withdrawal that would have left the account with less than £10K, it wasn't proceeding. Calling them up and converting it into a full transfer unlocked the process.

- Eventually, the money moved from Vanguard to At Sipp. At Sipp then moved the funds (as mentioned in the IBKR template form) from your cash account with them to IBKR.

Eventually, this morning everything came together and I now have a functioning IBKR pension account with funding. I just placed my first successful order!

Comments

Then i contacted optionspenions. The communication is so excruciatingly slow! Dont know why! Do they not want new business?

There is a third option now with Westerby, But they dont have any online reviews. I am a bit sceptical because of this.

I spoke to AtSipp, but i got a feeling that they prefer people moving there through a financial advisor and i dont have one.

Then i spoke to OptionsPensions, the communication is so excruciatingly slow! Do they not want new business??

Then there is another option with Westerby, the site looks modern and their communcation is very quick. But they dont have any online reviews. So i'm a bit sceptical because of that..

I spoke to AtSipp, but i got a feeling that they prefer people moving there through a financial advisor and i dont have one.

Then i spoke to OptionsPensions, the communication is so excruciatingly slow! Do they not want new business??

Then there is another option with Westerby, the site looks modern and their communcation is very quick. But they dont have any online reviews. So i'm a bit sceptical because of that..

Are you still happy with your move to IBKR? Yes

To be fair, AtSipp is not the greatest in terms of responsiveness, but if you get on a call with them, you should be able to resolve the issue.

They said they prefer people who move to Atsipp via a financial advisor.. - what does preference mean here? Just tell them you want to proceed nevertheless. Are they preventing you from proceeding?