What’s the true ROI of owning a flat? (What-Ifs)

In my previous post, I had documented the true ROI I had received from owning and eventually selling it and going through the lifecycle of the investment.

For obvious reasons, the ROI there isn't stellar. It was just at the borderline of the inflation rate over the years, which means it just about preserved my capital, but did not generate any. Incidentally, I wouldn't have needed to pay any capital gains, because the gains didn't even keep pace with the indexation benefits over the years.

Surely there must be unique factors specific to my investment that could be dragging down ROI? Is it then possible that under different circumstances, the ROI would have been significantly higher?

This is quite possible. Property investments almost always have a unique story and it is very tough to generalize what happens on the average case. However, what is possible is to tweak my particular experience to see if there is a significantly different outcome.

I have run 4 simulations on the data to see what might have happened. So I present the results. Following the trend of sharing my raw data, you can find the raw data of the simulations here.

This is actually an optimistic scenario. My original investment got me a barely furnished apartment and my wife and I penny pinched along way to even get the furnishings done in this budget. It is unlikely that ₹ 3,00,000 would have made the apartment significantly better to gain a 50% higher rent uniformly across the life cycle. But assuming such optimistic scenarios, we arrive at a yield of 9.16%, a clear 1% gain in XIRR rate. Nothing to scoff at.

Take the base data and applying 100% occupancy gets return to 9.31%. This is an 1.15% top up on the current XIRR. Again, nothing to scoff at.

In my case I had the apartment on sale for a little over a year., which is a fairly long time to wait for the right price. Despite that it is possible it didn't fetch the right price. So, I ran a simulation that sets the sale price at ₹ 50,00,000 (instead of the real-life ₹ 39,50,000). With this the XIRR jumped a long way to 10.53%. This is a significant jump over the original XIRR.

For the purpose of this simulation, I selected Franklin India Taxshield - it is a somewhat conservative fund, meant to be used for Sec 80C tax benefits, originally with a 3 year lock in on investments. The fund is probably a good selection because it would offered very similar tax benefits as a flat purchase in India.

This brings about the XIRR to a whopping 13.91%, a massive 6% on top of the original XIRR. The extra 6% increases the final outflow to ₹ 69,37,000 (instead of the real-life ₹ 39,50,000), giving a 75% upside over the market.

Remember that in this scenario, you would also never be in debt, as you haven't raised a loan. You are just replacing your payments to the bank with investments into the fund.

As before, all data is here. Feel free to perform your own simulations. Leave a note if you find anything interesting.

More on this topic at this blog post on why your home is not an investment, and in part 2 of what-if analysis.

For obvious reasons, the ROI there isn't stellar. It was just at the borderline of the inflation rate over the years, which means it just about preserved my capital, but did not generate any. Incidentally, I wouldn't have needed to pay any capital gains, because the gains didn't even keep pace with the indexation benefits over the years.

Surely there must be unique factors specific to my investment that could be dragging down ROI? Is it then possible that under different circumstances, the ROI would have been significantly higher?

This is quite possible. Property investments almost always have a unique story and it is very tough to generalize what happens on the average case. However, what is possible is to tweak my particular experience to see if there is a significantly different outcome.

I have run 4 simulations on the data to see what might have happened. So I present the results. Following the trend of sharing my raw data, you can find the raw data of the simulations here.

Higher Rents

I have seen other property owners often spend a bit more money in furnishing the apartment significantly better than what I did. Most do this because they like to live a better furnished house themselves, but many do because it is expected to increase rental yields. In my first simulation, I assume that I spend ₹ 3,00,000 initially (instead of the ₹ 1,30,000 I actually did), but assumed that both the notional rents and the actual rents go up by 50%.| src: https://www.nytimes.com/2015/01/25/realestate/for-sale-multimillion-dollar-homes-fully-furnished.html |

100% Occupancy

In my experience, the apartment was either occupied by my family or rented out, only for about 77% of the time. If you live in the apartment all along, you retain 100% occupancy. It is possible to have a single tenant occupy your apartment throughout your ownership giving you 100% occupancy. The latter is a highly optimistic scenario, but possible. Remember, we are doing what-ifs here. |

| src: https://en.wikipedia.org/wiki/Pigeonhole_principle |

Take the base data and applying 100% occupancy gets return to 9.31%. This is an 1.15% top up on the current XIRR. Again, nothing to scoff at.

Higher Sale Price

The third possibility is that I sold it when the market isn't a sellers market. What if the sale price was significantly higher than the current sale price. Among the what-if scenarios, this is the most likely one to have panned out for most other property owners. An astute seller will wait till the buying price is right.In my case I had the apartment on sale for a little over a year., which is a fairly long time to wait for the right price. Despite that it is possible it didn't fetch the right price. So, I ran a simulation that sets the sale price at ₹ 50,00,000 (instead of the real-life ₹ 39,50,000). With this the XIRR jumped a long way to 10.53%. This is a significant jump over the original XIRR.

No Bank Loan

The final simulation I wanted to run was to check what would happen if I hadn't taken a loan out. What if I had the money to put into buying the apartment and avoided the interest and fees that I paid to the bank over the years? Turns out, that this simulation has an effect of increasing the XIRR to 9.5%.| src: https://www.washingtonpost.com/news/where-we-live/wp/2017/04/11/planning-to-borrow-from-your-401k-for-that-home-down-payment-it-may-not-be-as-easy-as-you-think/ |

Comparison to Stock Market

Finally, what would have happened if I had taken all my cash outlays in the apartment and invested it in a mutual fund, and used the same fund to withdraw cash for the rents that would have supplanted the notional rent and rent inflows I enjoyed? This simulation gets a lot more interesting.For the purpose of this simulation, I selected Franklin India Taxshield - it is a somewhat conservative fund, meant to be used for Sec 80C tax benefits, originally with a 3 year lock in on investments. The fund is probably a good selection because it would offered very similar tax benefits as a flat purchase in India.

This brings about the XIRR to a whopping 13.91%, a massive 6% on top of the original XIRR. The extra 6% increases the final outflow to ₹ 69,37,000 (instead of the real-life ₹ 39,50,000), giving a 75% upside over the market.

Remember that in this scenario, you would also never be in debt, as you haven't raised a loan. You are just replacing your payments to the bank with investments into the fund.

Summary

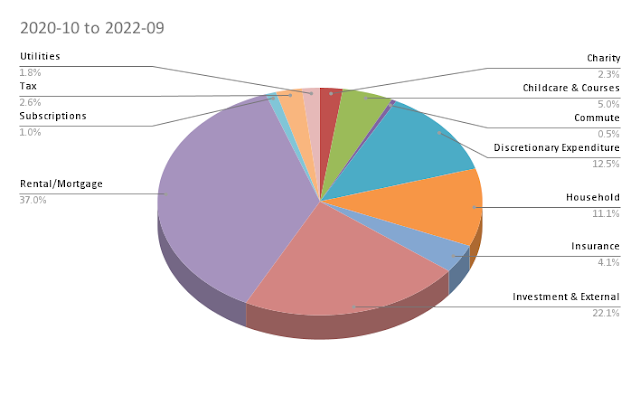

Here is a summary of the various simulations I ranMore on this topic at this blog post on why your home is not an investment, and in part 2 of what-if analysis.